WRITTEN DOWN VALUE DEPRECIATION | JAIIB MAY 2024 EXAMS

In this article, we will be discussing one of the important & most common methods of depreciation calculation for the JAIIB AFM Exams 2024 due the upcoming May along with the Study Material which is applicable for the Accounting & Financial Management for Bankers (AFM) Exam 2024.

But before we begin with the depreciation method i.e. WDV, we would like to tell you about the latest Video Classes of AFB paper of JAIIB to help you score good marks this 2023 attempt.

PASS JAIIB AFM MAY 2024 WITH THE BEST JAIIB AFM VIDEO CLASSES

Have you been struggling with JAIIB’s paper of AFM? Do you find it hard understand the practical concepts?

If yes? Then you must take Learning Sessions latest JAIIB Video classes for your JAIIB success! We ensure that our faculty’s concept delivery is very good & after going through our classes of any paper, you will understand what you have been taught.

More than 25000 bankers passed their JAIIB Exams last DEC 2023. You can also be the part of the family & pass the upcoming JAIIB MAY 2024!

Here are the key highlights of IIBF Junior Associate of the Indian Institute of Bankers Video Classes 2024:

- Latest JAIIB Syllabus for MAY 2024

- Live + Recorded Sessions of JAIIB subjects prepared & delivered by Expert faculty

- 24 by 7 access to materials on apps & browser as per the convenience of aspirants

- Unlimited views of JAIIB Video Classes

- The JAIIB Video classes are downloadable lectures (recorded ones)

- Mock Tests & Mega Mock Tests which includes Memory Recalled Questions ofIE&IFS, PPB, AFM, RBWM

- Flexible packs to choose as per the requirement & subject preference

- English language / Hinglish language for the JAIIB classes are available

Now, all that you need to access the JAIIB courses is through:

- Android App: LS PRO or IIBF LEARNING CENTER

- iOS App: My Institute (Code: gegkt)

- Website for Exam Materials: info

DEPRECIATION

Depreciation is the method of deducting the T. cost of asset you bought for your company. But instead of doing it all in 1 year, the cost of asset is written off in parts of it over a period time. When the assets are depreciated, one can plan how much cost will be written off each year, giving more control over the finances of business.

The numeral years over which assets are depreciated, time is determined by their useful life (Ex: a laptop might be useful for 4 years).

For tax depreciation, different assets are categorized into various classes, and each class has its own practical life. If your company uses a different method of depreciation for financial statements, the asset’s useful life can be based on how long they expect to use the asset in the business.

Ex: Income Tax laws might require that computer equipment be depreciated over 5 years, but if you know it will become useless in 2 years, then you can depreciate the computer equipment over a shorter time.

So, depreciation can be defined as a continuing and gradual decrease in the book value of fixed assets due to passage of time, constant use and obsolescence.

Types of Depreciation

There are different depreciation methods which are used to depreciate the asset such as:

- Straight-line method (SLM)

- Unit of production method

- Written Down Value method (WDV) / Declining balance method (DBM)

- Double-declining balance method (DDBM)

In this particular article, we will be discussing the WDV depreciation method:

What Induces Depreciation on Asset/Assets?

To understand what induces depreciation in assets, we first have to understand what defines the cost of the asset & the subsequent WDV of the asset.

The elements that determine the value of the asset & lead to diminishment in the value of an asset includes:

- the location of the asset,

- amenities offered in the area where the asset is located,

- Economic conditions

- Availability of land in the area

- environmental factors such as pollution and water shortage, and

- the overall infrastructure, among other things.

WRITTEN DOWN VALUE METHOD

Under the Written Down Value method, depreciation is charged on the book value (cost –depreciation) of the asset every year commonly known as WDV of the asset. Since the book value keeps on reducing so, the annual depreciation also keeps on decreasing.

This method is also known as the ‘Diminishing Balance Method’ or ‘Reducing Instalment Method’. While applying the depreciation rate both salvage or scrap value and removal costs are ignored. It is not possible to reduce the book value to zero; but it can be reduced close to its salvage value at the end of its useful life.

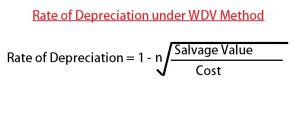

FORMULA FOR WRITTEN DOWN DEPRECIATION

Depreciation Rate = 100 {1 – n√ s/c }

where , n = number of years

S = Salvage value

C = cost of asset

SUITABILITY OF WRITTEN DOWN VALUE METHOD:-

This method is most suitable for those assets that have more efficiency in the beginning and later on decrease year after year. This method is usually adopted for plant and machinery, fixtures and fittings, motor vehicles, etc. An asset gives more value to a business in the initial years than later year, therefore, this method is considered as the most logical method of depreciation.

ADVANTAGES OF WRITTEN DOWN VALUE METHOD:-

- It recognizes the risk of obsolescence by charging the major part of depreciation in the early years of the life of the asset.

- Income-tax authorities recognize this method.

DISADVANTAGES OF WRITTEN DOWN VALUE METHOD:-

- This method does not take into consideration the interest on capital invested in the asset

- Under this method, the value of the asset can never be reduced to zero .

YOU MAY ALSO LIKE :

Significance of the Written Down Value Method (WDV)

The written down method of depreciation is the best applicable method to compute the depreciation expense whenever an asset faces a risk of obsolescence & starts to get outdated in the market. It is an effective way to provide the organization with the fair market value (FV) of the asset once the asset has finished its functional life and has become outdated. This is the proper method to arrive at the expenses that fit with the revenues as the asset provides usage in the early years of its useful life.

In the same way, the reduced utility at the later or last stage of the asset’s useful life and under such a scenario heavy depreciation expense is charged which is subsequently reduced to lower levels at the later/last stage of the asset’s useful life.

GET IN TOUCH WITH US

To get offers on the JAIIB, CAIIB or other IIBF Certification Exams or Bank Promotion Exams, you can talk to us on our Whatsapp No.: 8360944207

For regular banking related updates & free updates you can join us on:

- Telegram Channel: IIBF Telegram Group

- YouTube Channel: Learning Sessions

- Instagram: Learning Sessions

All the Best for your IIBF JAIIB Exams 2024!

Team: Learning Sessions

Also Like:

I watch the lecture of depreciation of sandhya mam. She explained so well in the lecture and cleared my all doubts. Thanku so much mam.

I just read your articles and clear all my doubts related to depreciation.