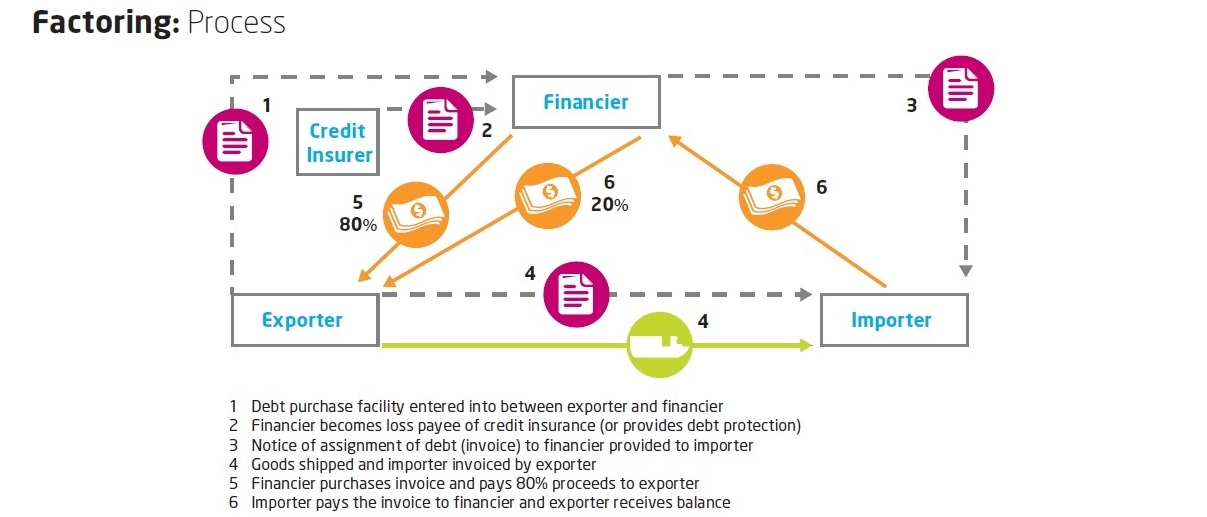

What is Factoring?

Factoring, receivables factoring or debtor financing, is when a company buys a debt or invoice from another company. Factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context. In this purchase, accounts receivable are discounted in order to allow the buyer to make a profit upon the settlement of the debt. Essentially factoring transfers the ownership of accounts to another party that then chases up the debt.

📚 JAIIB Study Resources 📚

👉 Check Here

👉 Check Here

👉 Check Here

👉 Get Tests Here

👉 Check Here

Factoring therefore relieves the first party of a debt for less than the total amount providing them with working capital to continue trading, while the buyer, or factor, chases up the debt for the full amount and profits when it is paid. The factor is required to pay additional fees, typically a small percentage, once the debt has been settled. The factor may also offer a discount to the indebted party.

Also See: How to Calculate PVIF and PVIFA on Simple Calculator in 10 Seconds

Factoring is a very common method used by exporters to help accelerate their cash flow. The process enables the exporter to draw up to 80% of the sales invoice’s value at the point of delivery of the goods and when the sales invoice is raised.

What is…Forfaiting?

Forfeiting (note the spelling) is the purchase of an exporter’s receivables – the amount that the importer owes the exporter – at a discount by paying cash. The purchaser of the receivables, or forfeiter, must now be paid by the importer to settle the debt. This is a common process used for speeding up the cash flow cycle and providing risk mitigation for the exporter on 100% of the debts value.

As the receivables are usually guaranteed by the importer’s bank, the forfeiter frees the exporter from the risk of non-payment by the importer. When a forfeiter purchases the exporter’s receivables directly from the exporter then it is referred to as a primary purchase. The receivables technically then become a form of debt instrument that can be sold on the secondary market as bills of exchange or promissory notes, this is known as a secondary purchase.

oh i understand that thank u very much but please can you answer me Last Question :-Is it wise to rent 200 and extend them to 240 days and buy a golden or rent 250 and extend them for 240 days and earn money(IF POSSIBLE. Can I?) for Golden.

You completed various nice points there. I did a search on the subject and found a good number of people will consent with your blog.

Thanks for posting this piece of writing. I’m without doubt frustrated with struggling to search out relevant and brilliant commentary on this subject. Everybody now goes to the very far extremes to either drive home their viewpoint that either: everyone else in the planet is wrong, or two that everyone but them does not in actuality understand the situation. Many thanks for your succinct, applicable insight.

That is really fascinating, You are a very skilled blogger. I have joined your rss feed and stay up for in search of more of your magnificent post. Additionally, Ive shared your web site in my social networks!

Fairly insightful publish. Never thought that it was this simple after all. I had spent a very good deal of my time looking for someone to explain this topic clearly and you’re the only 1 that ever did that. Kudos to you! Keep it up

Factoring & forfeiting is an important topic and i prepared it with the help of learning sessions.